September Property Investment Industry News

September continues to demonstrate that, despite the expected turbulence of Brexit, the UK is continuing to grow, and property investment is still considered a sensible choice, especially for those nearing retirement age, or those lucky expats in the UAE with a tax free pension pot to put to good use. To learn more about UK property investment, click here.

Brexit, Schmexit: Foreign Investors Still Interested in the UK

The Economist noted this month that, despite many negative warnings about the economy post Brexit, the buy-to-let property market is remaining buoyant, and investment into the UK doesn’t seem to be suffering. The key points of the article are:

- Negative predictions about investment post-Brexit have been wrong so far

- Foreign investors are still interested, and actually benefit by getting more for their money

- Britain still has an ‘attractively low’ rate of corporation tax.

Northern Cities Soar, while London Marks First Fall in House Prices for Eight Years

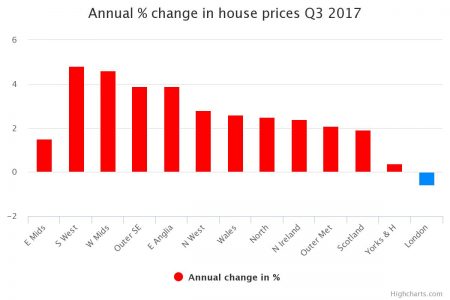

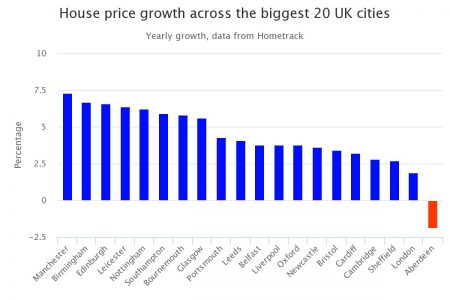

The Telegraph has reported that London house prices have registered their first annual decline in eight years – making the capital the worst performing region in Britain. The same article reports on the Hometrack house price analysis, which demonstrates fantastic growth for property in Manchester, Birmingham and Edinburgh. The below graphs demonstrate the changes shown in the UK house prices:

Pensions Primed for Buy-To-Let Investment

In a study featured in the Financial Times this month, it was stated that more than 1 in 10 people look to invest in buy-to-let property after they retire. The potential amount of new landlords could equal as many as 1.3 million. The main reasons given for investing in property were:

- Strong capital growth

- A regular income

- Boost to their pension.

Remember the double tax agreement between the UK and UAE? Back in February, it was announced that UK expats over 55 can cash out their pension pots tax free. Click here to for more investment advice!

Property Investment is booming in Manchester

Manchester has been touted, by Landlord News, as the ‘Next Silicon Valley’, due to its high number of employees in the tech industry and the expansion of Media City (the home of ITV, Channel 4 and the second home of BBC).

- Manchester is predicted to be one of the top 5 fastest growing cities from 2017 to 2021

- Manchester is home to almost 52,000 tech workers (the largest tech workforce outside London)

- The expansion of Media City will welcome more workers, and increase the already high digital turnover of £2.9bn (4th highest in the UK)

Buyer Demand Continues to Trend Upwards Across the UK

Property Wire has reported on survey results which suggest buyer demand in the UK is showing no sign of slowing. The survey suggests that the current imbalance between supply and demand of properties has stoked up buyers’ interests, which when combined with climbing prices, demonstrates that the property market is still continuing to perform. Some specifics of the results are:

- Bristol is the hottest county in England, with buyer demand currently at 57%

- Edinburgh also ranks highly, with buyer demand at 56%

- CEO of eMoov notes that sales are continuing to climb and buyer demand is remaining strong

London fails to perform as buyers turn to regional cities

September showed the biggest drop on asking prices in London this decade, according to The Guardian. This slump is not mirrored in regional cities, with the East and North of England all continuing to rise. The stand out figures between September 2016-2017 are as follows:

- London is showing a -3.2% price change

- The East of England is showing a 2% rise

- The Midlands are showing the largest change, with rises as high as 5.5% showing in the East Midlands, and 4.4% in the West Midlands.

If you are interested in exploring property investment in the UK, visit the Grant Property investment website at www.gp-invest.com